Some Known Details About Feie Calculator

Wiki Article

Feie Calculator for Beginners

Table of Contents6 Simple Techniques For Feie CalculatorUnknown Facts About Feie CalculatorSome Known Questions About Feie Calculator.Little Known Questions About Feie Calculator.The Best Strategy To Use For Feie CalculatorFeie Calculator - QuestionsFeie Calculator for Beginners

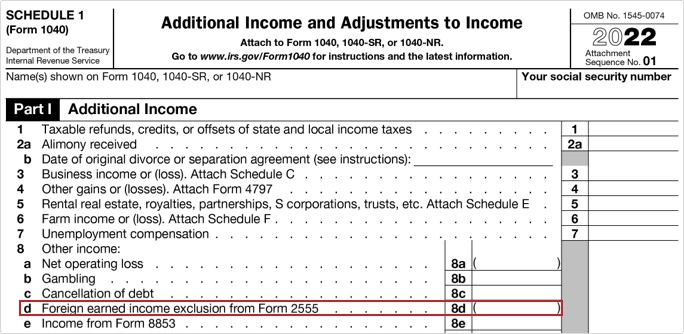

If he 'd regularly taken a trip, he would certainly rather complete Component III, noting the 12-month period he satisfied the Physical Existence Test and his traveling background. Action 3: Reporting Foreign Income (Part IV): Mark earned 4,500 per month (54,000 every year).Mark computes the currency exchange rate (e.g., 1 EUR = 1.10 USD) and transforms his wage (54,000 1.10 = $59,400). Given that he stayed in Germany all year, the percent of time he resided abroad during the tax obligation is 100% and he gets in $59,400 as his FEIE. Mark reports complete earnings on his Form 1040 and enters the FEIE as an unfavorable quantity on Arrange 1, Line 8d, reducing his taxable income.

Selecting the FEIE when it's not the most effective alternative: The FEIE might not be optimal if you have a high unearned earnings, earn even more than the exemption limit, or stay in a high-tax country where the Foreign Tax Credit History (FTC) may be much more valuable. The Foreign Tax Obligation Credit Report (FTC) is a tax obligation decrease approach typically utilized combined with the FEIE.

Our Feie Calculator Diaries

deportees to offset their united state tax obligation financial debt with foreign revenue tax obligations paid on a dollar-for-dollar reduction basis. This implies that in high-tax nations, the FTC can usually remove U.S. tax financial debt completely. Nevertheless, the FTC has limitations on qualified taxes and the optimum case amount: Qualified taxes: Only revenue taxes (or taxes instead of revenue taxes) paid to foreign federal governments are qualified.tax obligation liability on your international income. If the foreign taxes you paid surpass this limitation, the excess international tax obligation can usually be continued for as much as ten years or carried back one year (by means of a changed return). Keeping exact records of foreign income and taxes paid is for that reason crucial to computing the correct FTC and maintaining tax compliance.

expatriates to reduce their tax obligations. If an U.S. taxpayer has $250,000 in foreign-earned income, they can omit up to $130,000 making use of the FEIE (2025 ). The remaining $120,000 might after that undergo taxes, but the united state taxpayer can possibly apply the Foreign Tax obligation Credit to counter the tax obligations paid to the international nation.

What Does Feie Calculator Mean?

He marketed his U.S. home to establish his intent to live abroad permanently and applied for a Mexican residency visa with his other half to aid fulfill the Bona Fide Residency Test. Neil directs out that purchasing residential property abroad can be challenging without very first experiencing the area."We'll most definitely be outside of that. Even if we return to the United States for medical professional's appointments or business phone calls, I question we'll spend greater than 30 days in the US in any kind of offered 12-month period." Neil highlights the significance of rigorous tracking of united state gos to. "It's something that people require to be actually attentive concerning," he claims, and encourages deportees to be cautious of typical mistakes, such as overstaying in the U.S.

Neil bewares to tension to U.S. tax obligation authorities that "I'm not carrying out any type of organization in Illinois. It's just a mailing address." Lewis Chessis is a tax obligation expert on the Harness platform with substantial experience helping united state people browse the often-confusing world of global tax obligation compliance. Among the most typical misunderstandings among U.S.

The Ultimate Guide To Feie Calculator

income tax return. "The Foreign Tax Credit enables individuals working in high-tax nations like the UK to offset their united state tax responsibility by the amount they've already paid in tax obligations abroad," states Lewis. This makes certain that expats are not taxed twice on the same earnings. Those in reduced- or no-tax nations, such as the UAE or Singapore, face added hurdles.

The possibility of lower living prices can be appealing, however it often includes compromises that aren't instantly apparent - http://169.48.226.120/www.feiecalculator.nation.ly. Housing, for instance, can be a lot more budget-friendly in some nations, yet this can suggest endangering on framework, security, or access to trustworthy energies and services. Affordable properties could be located in locations with inconsistent web, minimal mass transit, or unstable healthcare facilitiesfactors that can significantly affect your everyday life

Below are several of one of the most often asked concerns about the FEIE and various other exemptions The Foreign Earned Revenue Exclusion (FEIE) allows U.S. taxpayers to leave out as much as $130,000 of foreign-earned earnings from government earnings tax obligation, decreasing their united state tax obligation responsibility. To receive FEIE, you have to fulfill either the Physical Existence Test (330 days abroad) or the Bona Fide House Examination (verify your key residence in a foreign nation for an entire tax year).

The Physical Existence Examination additionally calls for United state taxpayers to have both an international earnings and a foreign tax obligation home.

Some Known Questions About Feie Calculator.

An earnings tax obligation treaty in between the united state and an additional nation can help avoid double taxes. While the Foreign Earned Revenue Exemption lowers taxed revenue, a treaty may provide fringe benefits for eligible taxpayers abroad. FBAR (Foreign Checking Account Report) is a needed declaring for united state people with over $10,000 in international monetary accounts.

Neil Johnson, CPA, is a tax advisor on the Harness system and the creator of The Tax obligation Dude. He has more than thirty years of experience and now focuses on CFO services, equity compensation, copyright tax, cannabis taxes and divorce related tax/financial preparation issues. He is an expat based in Mexico.

The international gained earnings exemptions, occasionally referred to as the Sec. 911 exclusions, omit tax obligation on salaries gained from working abroad.

The 7-Minute Rule for Feie Calculator

The tax benefit excludes the revenue from tax obligation at lower tax prices. Previously, the exemptions "came off the top" reducing income subject to tax obligation at the top tax prices.These exemptions do not spare the wages from United States taxes however simply supply a tax obligation reduction. Note that a single individual functioning abroad for all of 2025 who made concerning $145,000 without any important link various other income will have taxable earnings decreased to zero - efficiently the same solution as being "free of tax." The exemptions are computed daily.

If you went to business conferences or seminars in the US while living abroad, revenue for those days can not be omitted. For US tax obligation it does not matter where you maintain your funds - you are taxed on your around the world earnings as a United States person.

Report this wiki page